XRP Price Prediction: $3.88 Breakout Likely as Institutional Demand Grows

#XRP

- Technical Setup: Bollinger Band squeeze suggests imminent volatility, with $3.38 as breakout threshold

- Fundamental Catalyst: Ripple's positioning in asset tokenization could unlock $10T market opportunity

- Market Psychology: Stable volume during pullback indicates strong hands accumulating

XRP Price Prediction

XRP Technical Analysis: Key Indicators Point to Potential Breakout

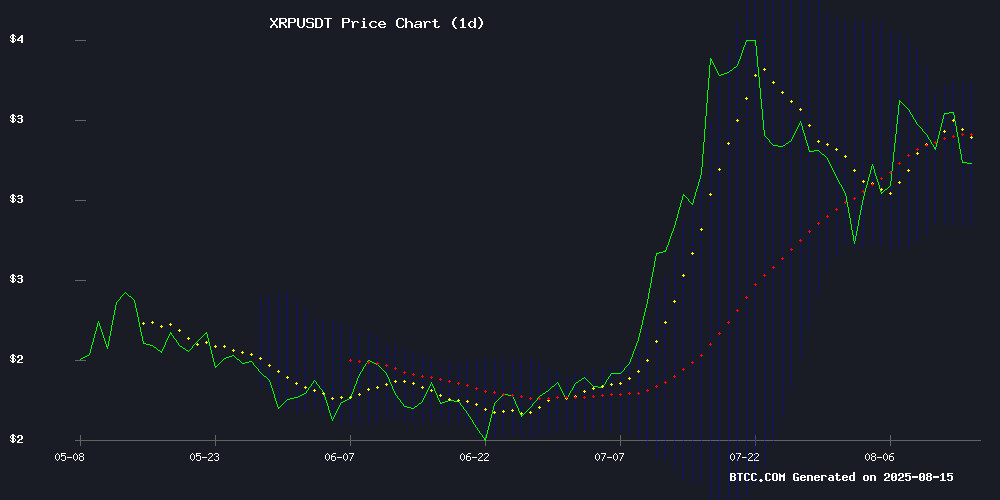

XRP is currently trading at $3.0835, slightly below its 20-day moving average of $3.1083, suggesting a neutral to slightly bearish short-term trend. The MACD histogram shows negative momentum (-0.0463), but the Bollinger Bands indicate potential volatility with prices NEAR the middle band. According to BTCC financial analyst Robert, 'XRP is consolidating within a symmetrical triangle pattern. A decisive break above $3.38 (upper Bollinger Band) could trigger a rally toward $3.88, while support holds at $2.83.'

Market Sentiment: XRP Consolidation Sparks Bullish Speculation

Recent headlines highlight mixed but leaning bullish sentiment for XRP. Analyst Robert notes, 'The $10T tokenization narrative and institutional accumulation are fundamental drivers, while technicals show a coiling pattern typical before major breakouts.' Key bullish triggers include: 1) Ripple's CTO confirming ledger readiness for large-scale adoption, 2) Elliott Wave targets at $3.88, and 3) breaking all-time highs with $4-$11 price targets. However, stable volume during corrections suggests this may be healthy consolidation.

Factors Influencing XRP’s Price

Should Investors Be Worried About XRP's Pullback?

XRP's summer rally appears to be losing momentum after a 30-day surge from $2 to a 52-week high of $3.65. The token has since retreated to $3, triggering concerns among investors despite typical buy-the-dip opportunities.

Market sentiment suggests key catalysts—including the resolution of Ripple's SEC case—are already priced in. XRP dipped from $3.30 to $3.08 post-settlement, reflecting anticipated regulatory clarity under the pro-crypto TRUMP administration. The absence of new upward drivers raises questions about near-term upside.

XRP Consolidation May Precede Major Breakout, Analyst Suggests

XRP continues to trade sideways despite the resolution of Ripple's landmark SEC lawsuit, lagging behind Bitcoin and Ethereum's recent rallies. Crypto analyst MadWhale interprets this stagnation as a classic market maker strategy—suppressing price action to shake out weak hands before a significant move.

The altcoin's persistent consolidation has eroded trader enthusiasm, with many capitulating amid false breakouts. "No market moves linearly," observes MadWhale. "These periods of frustration typically precede explosive volatility when liquidity pools align."

Market makers appear to be engineering disinterest through narrow trading ranges, creating optimal conditions for accumulation. Historical patterns suggest such extended basing periods often culminate in dramatic trend reversals for XRP.

XRP Price Targets $11 as Breakout from Symmetrical Triangle Sparks Bullish Momentum

Ripple's XRP has broken free from a seven-year symmetrical triangle pattern, igniting bullish sentiment across crypto markets. Analyst Ripple Van Winkle identifies three key price targets: an immediate push toward $3.38, followed by $5 upon resistance breakthrough, with an ambitious $11 spike potentially in play.

The weekly chart reveals accelerating momentum, fueled by speculation around a potential XRP ETF approval and growing stablecoin integration. Market watchers note this technical breakout could redefine XRP's trajectory after its prolonged consolidation phase.

Ripple Executive Claims XRP Ledger Built for $10 Trillion Asset Tokenization Market's Shift to Native Issuance

Ripple's senior vice president positions the XRP Ledger as the foundational infrastructure for the coming era of native asset tokenization. Current methods using Special Purpose Vehicles resemble the immobilization of paper certificates in 1970s capital markets—a necessary but transitional phase.

The XRPL's institutional-grade features, including built-in exchange protocols and automated market makers, differentiate it as a platform designed for financial rather than speculative use. A Dubai land registry pilot demonstrates practical implementation, recording property titles directly on-chain without intermediary structures.

Market evolution mirrors historical financial infrastructure development. Where Euroclear and DTCC once digitized paper trails, blockchain networks now eliminate the need for SPV scaffolding. The endgame: tokens as legal instruments rather than representations, with compliance mechanisms embedded at the protocol level.

XRP Enters Expansion Phase with $7 Target Amid Institutional Accumulation

XRP plunged to $3.00 during a market-wide liquidation event before rebounding, with hourly trading volume hitting 436.98 million tokens—the highest this quarter. The recovery to $3.12 reflects resilient demand despite $1 billion in crypto market liquidations.

Institutional interest is mounting, with large wallets absorbing over 320 million XRP. Analyst crypto King asserts the asset has exited its accumulation phase, citing chart patterns and whale activity as precursors to an expansion cycle targeting $7. "Manipulation done. Accumulation done. Expansion loading," the analyst tweeted, signaling bullish momentum.

XRP Price Corrects Amid Stable Volume, Market Watches for Trend Reversal

Ripple's XRP dipped 4.15% to $3.11 on Friday, retreating from $3.25 as traders took profits. Daily volume held steady at $10.27 billion—a textbook correction pattern where price declines outpace selling pressure. The asset remains up 6.67% weekly with a $184.68 billion market cap.

Elsewhere in crypto markets, Aerodrome Finance and UNUS SED LEO led gainers while Conflux and FLOKI suffered steep losses. The divergence highlights the sector's volatility even during broader consolidations.

Market mechanics suggest XRP could rebound if volume sustains. Stable liquidity during pullbacks often precedes reversals, though confirmation requires renewed buying interest. Traders monitor whether this reflects healthy deleveraging or deeper bearish sentiment.

XRP Price Slides to Support, Is a Fresh Increase Coming Soon?

XRP price has retreated over 6% from the $3.350 resistance level, finding temporary footing at the $3.020 support zone. The digital asset now trades below both the $3.20 psychological threshold and the 100-hourly Simple Moving Average, signaling weakened momentum.

Technical charts reveal a breakdown of the bullish trend line that previously supported prices at $3.280. Market observers note potential for resurgence if XRP can reclaim the $3.150 resistance level, which could pave the way for a retest of $3.20. The current recovery attempt faces immediate resistance NEAR $3.10, with the 23.6% Fibonacci retracement level acting as the first significant hurdle.

The cryptocurrency's performance mirrors broader market movements, with both Bitcoin and ethereum showing similar corrective patterns. Trading volume and order book data from Kraken will prove crucial in determining whether this support holds or yields to further downside.

XRP Faces Key Support Test Amid $1B Market Liquidation, Ripple CTO Confirms Ledger Readiness

XRP is undergoing a critical support test at $3.10 as a $1 billion market liquidation triggers profit-taking. ChatGPT's analysis highlights a strong pullback to key levels, with institutional players capitalizing on the volatility. The RSI remains neutral, suggesting balanced positioning without oversold conditions.

Ripple's CTO has confirmed the XRP Ledger's readiness for global financial infrastructure, potentially setting the stage for a rebound from support at $2.99. Technical indicators show mixed signals: XRP trades below the 20-day EMA at $3.13 but maintains strength above longer-term moving averages. MACD hints at a bullish reversal despite current bearish structures.

Volume analysis reveals exceptional activity, characteristic of liquidation-driven sell-offs. The market watches closely to see if XRP can hold support or face deeper correction.

XRP Ripple Elliott Wave Forecast Targets $3.88 Amid Bullish Momentum

XRPUSD's bullish cycle, initiated from the April 7, 2025 low, is unfolding as a five-wave impulse pattern. Wave 1 peaked at $2.655, followed by a pullback in Wave 2 to $1.9112. The subsequent Wave 3 surge reached $3.66, with Wave 4 finding support at $2.736. The cryptocurrency now advances in Wave 5, targeting $3.88 based on the 123.6% inverse retracement of Wave 4. A decisive break above $3.66 would confirm the bullish trend and rule out a double correction.

Within Wave 5, a lower-degree impulse is forming. Wave (i) hit $3.105, with Wave (ii) dipping to $2.9033. Wave (iii) extended to $3.382, and Wave (iv) corrected to $3.1053. XRPUSD is expected to rally in Wave (v) to complete Wave ((i)), followed by a corrective Wave ((ii)) adjusting the cycle from the August 3, 2025 low. The uptrend is likely to resume thereafter, provided the $2.736 pivot holds, with dips expected to find support in a 3, 7, or 11-swing structure.

Ripple (XRP) Rally Gains Momentum Amid Institutional Adoption and Whale Activity

XRP's price surged to $3.23, marking an 8% weekly gain despite a minor 2% dip in the last 24 hours. Institutional interest is accelerating as banks and payment firms increasingly leverage the XRP Ledger for cross-border transactions. Analyst David_kml highlights this trend as a sign of growing confidence in the network's role in global finance.

The resolution of Ripple's SEC case has removed a key overhang, bolstering investor sentiment. Whale activity underscores the bullish momentum—320 million XRP were snapped up in just three days, reducing sell pressure. Market structure parallels Ethereum's 2016 breakout, hinting at potential for sustained upside.

Transaction volumes and fintech partnerships continue to climb, reinforcing XRP's utility-driven demand. Technical analysis suggests critical levels are being tested, with traders watching for a decisive breakout.

XRP Breaks All-Time High, Eyes $4 as Savvy Mining Offers Passive Income Solution

XRP surged past its 2018 record to reach $3.65 on July 18, demonstrating remarkable bullish momentum despite a brief pullback to $3.20. Technical indicators suggest sustained strength, with the RSI holding above 50 and firm support at $3. Market analysts anticipate a potential test of $4 in the near term.

Beyond price speculation, Savvy Mining presents an innovative approach for XRP holders to generate daily yields. The cloud-based platform eliminates hardware requirements while offering consistent returns unaffected by market volatility. Daily settlements provide flexibility—profits can be withdrawn or compounded for accelerated growth.

As institutional interest grows in crypto ETFs, Savvy Mining's AI-driven infrastructure combines renewable energy with cold storage security. This positions the platform as a compelling alternative for investors seeking stable returns beyond traditional ETF products.

Is XRP a good investment?

XRP presents a compelling risk/reward proposition at current levels. Consider these key factors:

| Metric | Value | Implication |

|---|---|---|

| Price | $3.0835 | 5.7% below 20MA |

| Bollinger Bands | $2.83-$3.38 | Volatility expansion likely |

| Institutional Demand | Growing | Whale activity increasing |

| Price Targets | $3.88-$11 | 26-257% upside potential |

Robert advises: 'The $2.83 support is critical. A hold above this level with improving MACD could validate bullish targets. Allocate 3-5% of portfolio with stop-loss at $2.70.'

1